OK, so you’re at a party and looking for something to talk about. Nothing is more entertaining than wading neck deep into politics. And few topics are more politically exciting than energy and climate change. So here are some talking points to really spice up those cocktail conversations (and maybe get you kicked out of the party).

Myth: The bankruptcy of Solyndra is proof that the government shouldn’t be funding clean energy projects

When I first told a relative of mine that I was shifting my career into clean energy, he shook his head solemnly. He said “Don’t you know that it is a dying industry? If it weren’t for the government throwing away billions of dollars on failed companies like Solyndra, then there would be no industry at all.”

Hmmmm. Let me unpack this a bit.

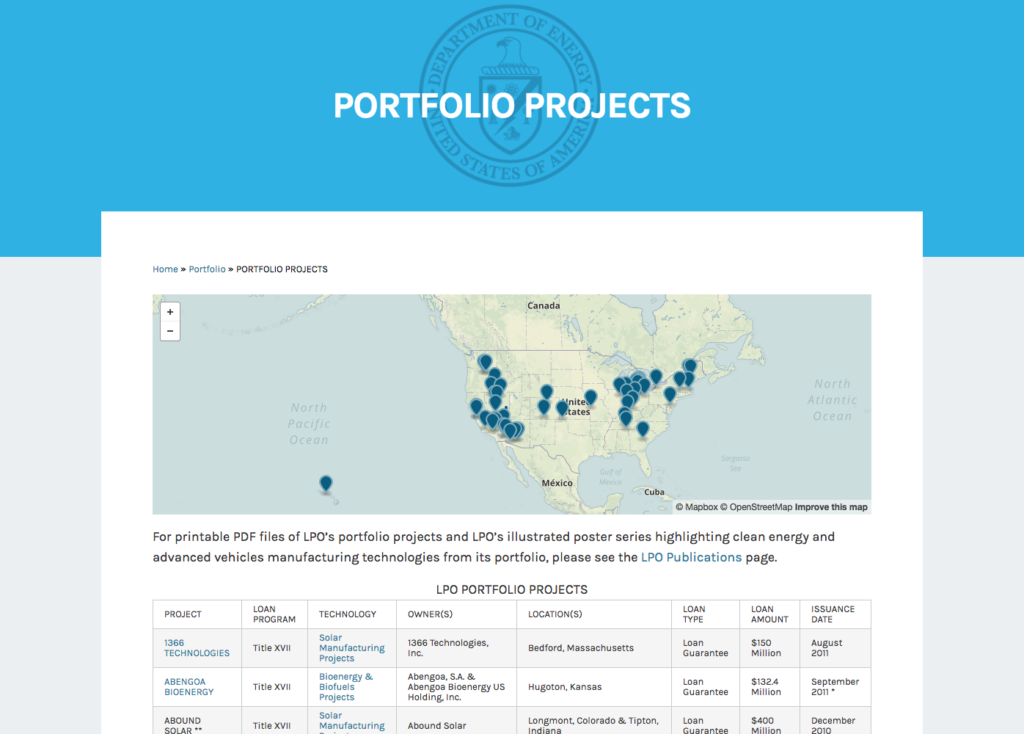

Solyndra was an advanced solar technology company that received a $525 million loan as part of a much larger $30 billion US loan guarantee package. The program was called the Energy Policy Act of 2005 and it was signed into law by President George Bush in 2005 (see the history). Its mission was to accelerate innovation in American clean energy and auto manufacturing. When President Obama came into office, he put the program to work and funded more than 30 companies. Because the fund focused on innovation and there were inherent risks, not every loan worked out. Three companies, including Solyndra, went bankrupt and the US government ended up on the hook for $780m.

GET MONTHLY NEWS & ANALYSIS

Unsubscribe anytime. We will never sell your email or spam you.

But what about the other 27 companies? One of them was Tesla. The US loaned Tesla $465 million in 2010. The company paid it back in full three years later, with interest. As of late 2016, the program had returned over $1.6 billion in interest payments – all the net proceeds go to taxpayers. The loan portfolio’s 2.3% loss ratio is better than most banks. Not bad for a program that was so heavily criticized.

Notably, the single largest recipient of the loan program is Georgia’s own Vogtle nuclear plant expansion. In 2014, the US guaranteed $8.3 billion (that’s billion with a “B”). After a series of delays and cost overruns, the US government increased the guarantee another $3.7 billion in September 2017 for a total guarantee of $12 billion. And in late 2017, Congress handed Vogtle another $1 billion in federal assistance, outside the loan guarantees. Needless to say, if the skepticism of the outgoing Georgia Public Commissioner pans out, and Vogtle continues to miss deadlines, the US and Georgia taxpayers will think Solyndra was a walk in the park by comparison.

The Freeing Energy Perspective

As you can see, the success or failure of the US government’s energy loan program has very little to do with Solyndra. The biggest bet of all is on nuclear and the second biggest bet, $5 billion, is on Ford Motor Company and their EV program. There is something for each political party to love and to hate in this program.

Assuming Vogtle goes operational and the loans are paid back, the expert’s projections of a $5-$6 billion return on the LPO seems very feasible. Whether they are Republican or Democratic, it’s a huge potential win for all taxpayers.

The world of clean energy is changing so quickly that even experts struggle to keep up. It’s not surprising the myths and misinformation pop up all around it. As the largest industry on earth, and one of the most heavily regulated, it’s a gold leaf invitation for politicians to get involved.

Stay tuned as we take on some even more provocative questions like, What do Republicans really think of clean energy…