Creating the definitive list of cleantech investment firms

The Freeing Energy team is putting together the definitive list of venture capital and private equity firms investing in clean energy technologies. We need your help.

TOPIC

There are a surprising number of options for financing clean energy startups and growth companies.

The Freeing Energy team is putting together the definitive list of venture capital and private equity firms investing in clean energy technologies. We need your help.

The Freeing Energy team is putting together the definitive list of venture capital and private equity firms investing in clean energy technologies. We need your help.

Bill Nussey joined Currents host, Todd Alexander, to discuss Bill’s new book and “… the shift to cleaner, cheaper energy.”

After the 2011 collapse of cleantech investing, the industry is starting to show signs of life once again. Investors are slowly dusting off their checkbooks. This article has four core questions and five parts of the value chain that investors should consider as they fund new cleantech companies.

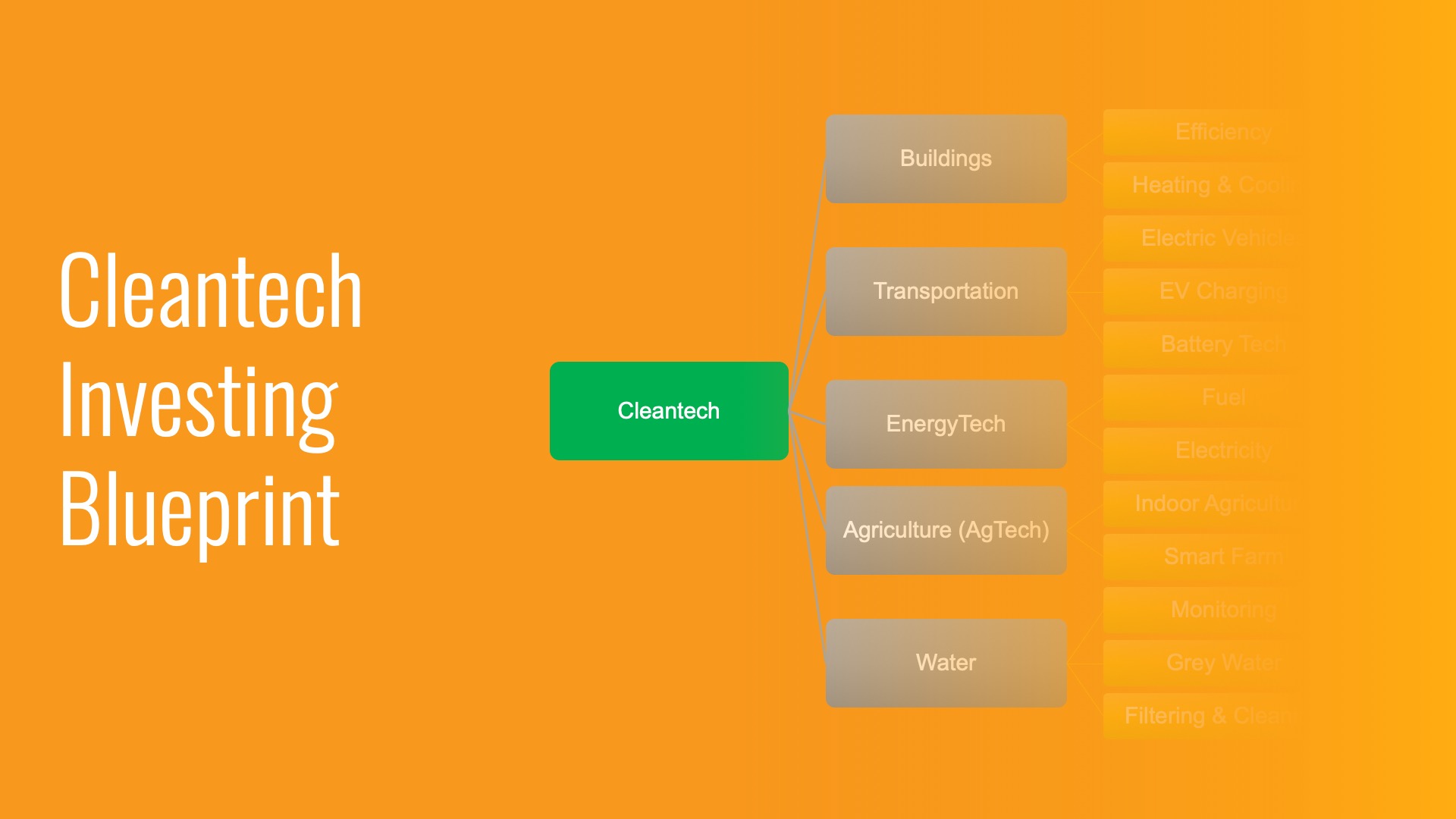

Cleantech is one of the biggest and most exciting technology industries today. But, despite the buzz, it remains complex and opaque. This article breaks it down into bite-sized chunks and explains how the terms and segments fit together.

Even conservative estimates forecast that transitioning to clean energy will require trillions of dollars of investments. Where will all this money come from? For better or worse, most of it will come from traditional sources like banks and governments. But, even thought it’s relatively smaller, venture capital will play a critical, catalytic role by lowering the risks for every other type of investment.

Clean energy is one of the largest business opportunities in history. But, in 2011, the US venture capital industry lost over $10 billion betting on it. What led to this cleantech collapse? And what did we learn as funding for cleantech is on the rise again?

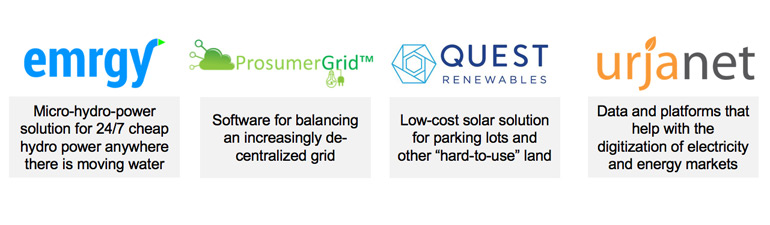

I was recently invited to speak a group of Georgia-based technology executives. I’ve included some excerpts from the slides and a list of some of the more exciting clean energy companies in the region.

On February 2, 2018, US$12 billion wind turbine giant, Vestas, acquired New York startup, Utopus Insights, for $100M in cash. Utopus provides several products including

Clean energy is the biggest business opportunity in history. Let me explain. To put this in perspective, look at the first bar above (1). The

© 2021 All rights reserved